By Tanu Jalloh

Budget Advocacy Network (BAN), supported by National Endowment for Democracy, has released its analyses of Sierra Leone’s Audit Service reports on the activities of the country’s National Revenue Authority (NRA) for 2011 and 2014.

Tax advocates in the country, among them the OpenTax Initiative and National Advocacy Coalition on Extractives (NACE), have reacted to what they described as a grim picture, complaining that tax leones unaccounted for would hurt development in a country where revenues generated locally fall far short of government expenditure.

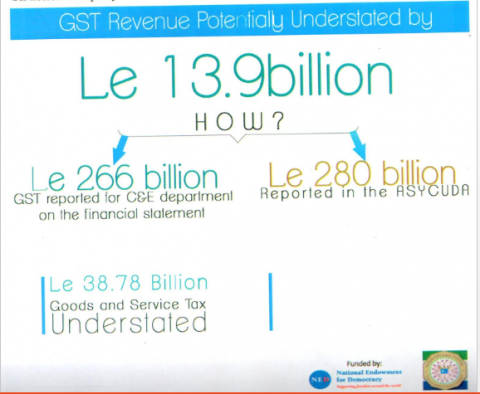

According to BAN the country’s tax authority could not account for over Le3.6 million ($484,000) of monies it collected in 2011 alone and Le13.9 billion of taxes potentially understated in 2014.

“This amount and other issues raised in the past Auditor General’s report, if addressed by NRA, would have helped reduce the budget deficit and increase government revenue.”

In 2015 the Journal of Economics and Sustainable Development observed that budget deficit has become an increasingly serious problem for Sierra Leone “due to unsound public expenditures, system of government, tax evasion and weak policy coordination between the fiscal and monetary authorities”.

The main audit issues raised in the findings were that in 2011 there were instances of late filing of annual tax returns; in 2012 duty free concessions were given to individuals and institutions who did not meet the eligibility criteria; in 2013 there were issues of non-payment of corporation tax by importers and no evidence for the payment of PAYE for Large Tax Payers for that year; and finally domestic revenue in the form of Goods and Services Tax (GST) were understated.

Unrecovered Funds

The budget advocacy network claimed that in 2011 cheques returned by the Bank of Sierra Leone, the country’s central bank, amounted to Le297 million; non-recovery of debt from dishonoured cheques amounted to Le201 million; and cheques of about Le25.6 million received from taxpayers and said to have been paid into the Consolidated Revenue Fund (CRF) do not reflect on the bank statement at all.

It further observed that over Le411.3 million as the first tax instalment payment by Leone Oil Limited for the year ended 31 December 2010 due on 31 March 2011 was not paid, adding that the company underpaid the second instalment by Le11.3 million. It also discovered discrepancies in Le146.7 million as monies for the sale of passports and passport forms and confirmed that there were no supporting documents for invoices and fuel chits amounting to over Le1.290 billion. Contracts given to contractors for the construction or rehabilitation valued at Le1.2 billion but no contract documents were provided.

Breach of MOU compliance provision

In 2014 the revenue generating authority did not comply with the MOU it had with Transit Banks. BAN discovered that monies collected by transit banks were not transferred to the Consolidated Revenue Fund in accordance with the timeframe of 24 hours as stipulated in the MOU. For instance, an examination of remittances from the First International Bank to the income tax account at the central bank revealed that three remittances with a total value of Le164.81million made in May of that year were observed to have been credited to the central bank in February 2015.

Failure to reconcile income tax payment at SLRSA

The reports by the group, the country’s foremost budget advocate, also found out that although commercial vehicles registration and licenses have income tax obligations, the income tax payments were not being kept by the revenue authority. There was no reconciliation between the Sierra Leone Roads Safety Authority (SLRSA) and NRA. Lack of evidence of payments and reconciliation made it impossible to ascertain whether all income tax obligations were being properly accounted for.

Foreign Travel Tax

The auditors discovered that although Le5.9 billion was reported as Foreign Travel Tax (FTT) on the financial statement, payment receipts could only be confirmed for Le4.7 billion. A balance of 1.2 billion could not be accounted for. Meanwhile, the auditors were unable to determine the actual amount that was meant to be paid as FTT to the NRA because complete airlines sales reports were not provided. Sales reports showed the total sales made by the airlines from which 10 per cent should have been deducted as FTT.

Misplaced duty waivers

The reports claimed that the ministry of finance’s data and literature on ASYCUDA revealed that an amount totaling Le300.48 million in respect of duty waivers was granted to nongovernmental organisations that were not registered for the period under review. Duty waivers was granted to a road construction company (SALCOST Sierra Leone) amounting to Le45.80 million in respect of wine and food stuffs which did not fulfill the criteria as stated in the Finance Act 2010 for duty concession to a road construction company.

The findings stated that with Le280 billion reported in the ASYCUDA and Le266 billion it was discovered that GST revenue potentially understated could amount to Le13.9 billion.

Engineer Andrew Keili, executive director of CEMMATS, a multidisciplinary and project management consultancy that has done extensive studies on the country’s tax system and extractive sector, further attempted to further catalogue the extent of the loss.

“In 2011, Sierra Leone spent more on tax giveaways than on its development priorities, with mining firms the biggest beneficiaries. The following year, the tax exemptions amounted to more than eight times Sierra Leone’s health budget and seven times its education budget. The losses arising from the GST waivers granted to the six mining companies alone (Le 648 billion) far exceed all the actual GST revenues collected by the government (Le410 billion)”, he said in a December 2016 statement he delivered to a SLEITI validation workshop in Freetown.

(C) Politico Online 2017