By Alimamy Jalloh

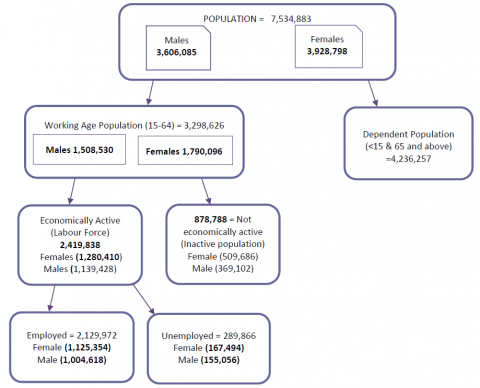

Of the 3,298,626 working age Sierra Leoneans in 2018 only 227,856 contributed to the National Social Security and Insurance Trust (NASSIT), which is the national retirement scheme, according to data published on NASSIT’s website.

The 2018 Sierra Leone Integrated Household Survey (SLIHS) reveals that, 2,129,972 working Sierra Leoneans were employed, including those that are self-employed. This means that about 93% of the people would not have a safety net for their retirement age.

The working age bracket in Sierra Leone, according to the Employers and Employed Act of 1965, ranges from 15 to 64 years old. However, job acquisition for many young Sierra Leoneans is still a challenge.

Self-employed workers make too little to afford to pay NASSIT 15% of their income.

In order to know the current number of Sierra Leoneans employed permanently and part-time, we submitted a Right to Access Information (RAI) request to the Ministry of Labor and Social Security (MLSS) on November 9, 2020, followed by an appeal on December 5. The MLSS failed to respond, in violation of the RAI Act, 2013. This is an issue that continues to affect data collection in the country leading to lack of adequate evidence based advocacy across all sector.

Back to our topic, many Sierra Leoneans young and old are self-employed due to the government’s inability to provide decent job for majority its citizens.

Mohamed Sesay, a young man from Freetown, says that he has a labour card from the MLSS, a diploma and work experience as a building engineer, but cannot find employment.

“I am a trained and qualified building engineer, but I do not have a job.” Sesay said he was not contributing to his retirement scheme, which is a serious concern for him. “If this continues, I won’t be able to take care of myself. Not now, when I am strong, and not later, when I get old,” he said.

A total of 317,365 working age people were unemployed in 2018, an increase of 83.4% over the past seven years, according to the SLIHS. But even those who are employed do not make a decent earning, as underemployment characterizes the labour market.

Self-employed worker, Alie B. Koroma, designs acrylic nails. He loves his job, but it hardly pays him enough to make a living.

“I can’t make much from this skill, so I can’t pay for my National Social Security and Insurance Trust as a self-employed person, though I would like to do so,” he said.

Current average retirement benefit is 628,000 Leones

According to its website, NASSIT pays 13 billion Leones monthly to their 20,693 registered pensioners, averaging Le 628,000 monthly per retirement beneficiary. The minimum wage is Le 600,000 monthly.

Self-employed persons must pay 15% of their monthly income to NASSIT for at least 180 months, or 15 years, in order to qualify for retirement benefits. The retirement benefits are calculated as 30% of the monthly average. In other words, if Alie B. Koroma’s salary is Le 1,000,000, he must contribute 150,000 of that to NASSIT every month and if he were to make 1,000,000 monthly consistently for 15 years, his retirement benefit will be 300,000 Leones monthly for the rest of his life once he reaches retirement age.

Gershon Lewis Wyse, an Insurance expert, stated that if the majority of the working age populations were employed and contributing to social security, it would help support the majority of the retirement age population when they can’t work anymore.

Instead, he said, “[The] majority of people within the working age are not [paying] social security, neither do they have health insurance. This is not good for the working population.”

Antique labour laws do not keep up with realities

In order to encourage people to pay, he said that government must raise the minimum wage, to also help low-income earners receive better monthly benefits when they retire.

“Some people who collect their monthly NASSIT benefits can hardly take care of themselves with what they get, because what they were originally contributing was very small because of their salaries,” Wyse said.

Ayouba Richard Sesay, a retired school Principal in Freetown, said that he had been receiving retirement benefits from NASSIT paid to his account monthly and he had been using it to support himself and his family but that the challenge of low income earning remained the same.

“My challenge is still the same: small salary while teaching, and small benefits while on retirement. Most importantly for me is that I have no job after retirement, and my benefit is not enough to take care of my needs and my family,” Sesay lamented.

Edmond Abu, Director of Native Consortium and Research Centre, a civil society organisation working on economic justice, in an interview urged the necessary authorities to treat Sierra Leone’s employment and job market with the seriousness it deserve and that the government must take all necessary steps in ensuring people are employed.

“The labour laws must be reviewed,” he added. “They are too old to match with the current trend and job market.”

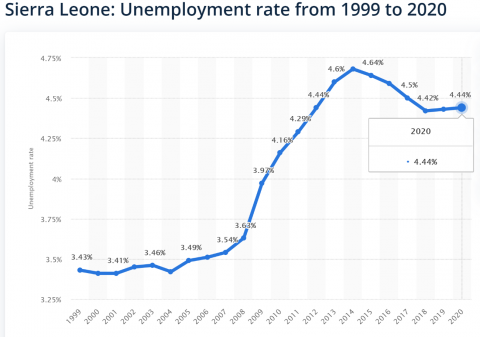

Despite official figures showing unemployment at just 4.4%, Abu said that the number of unemployment was alarming and worrying, and if the government did not take quick action to address it, it might lead to lawlessness. “Most of those who are in the working age are youth and some of them are involved in lawless activities like robbery.”

Abu also urged the government to raise the minimum wage, as most people can hardly take care of themselves and their families out of 600,000 Leones a month.

The SLIHS states that 21.4% of the economically active population comprises young people between 15 and 24 years old.

Copyright © 2021 Politico Online